2025 IN REVIEW

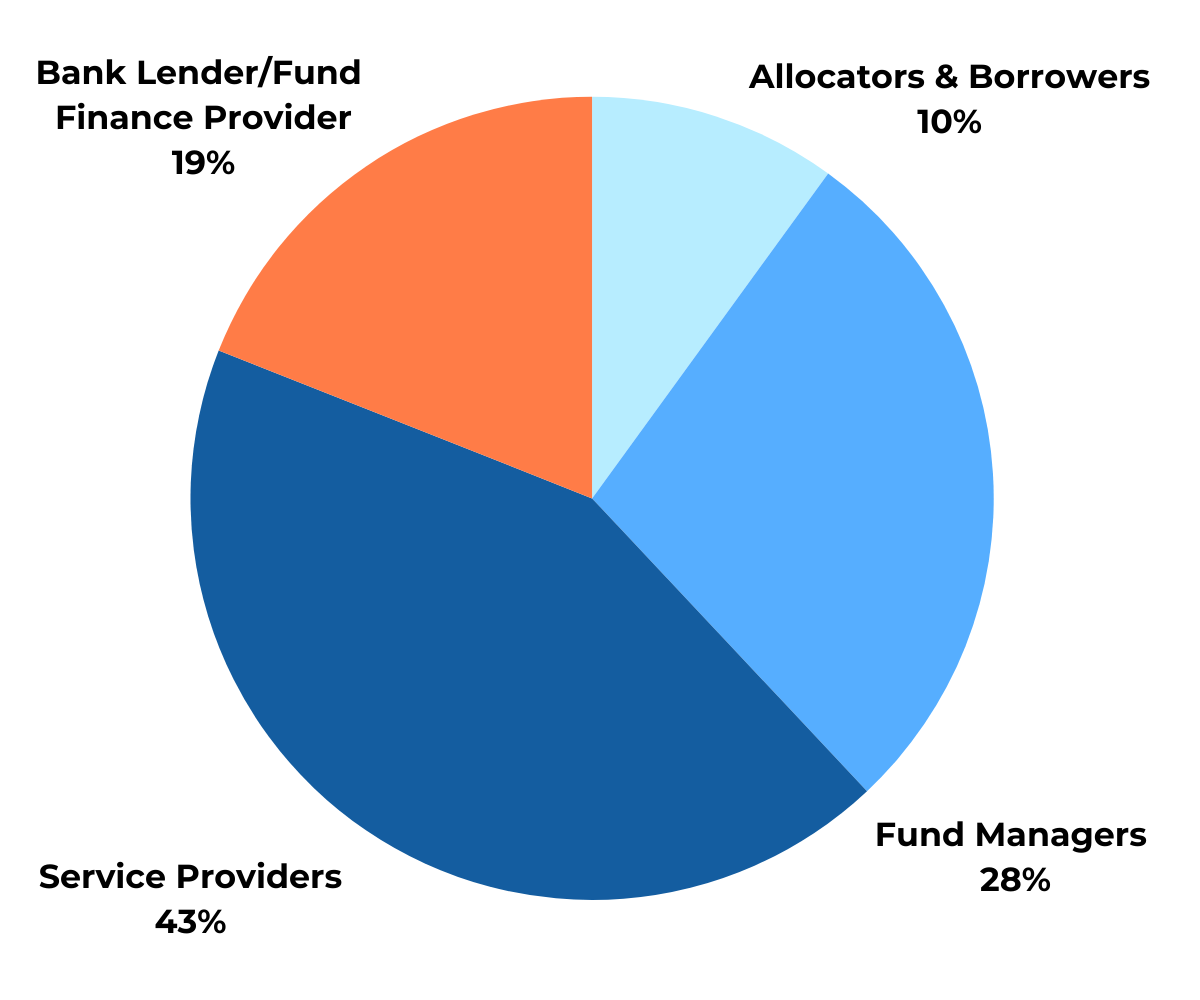

AUDIENCE BREAKDOWN

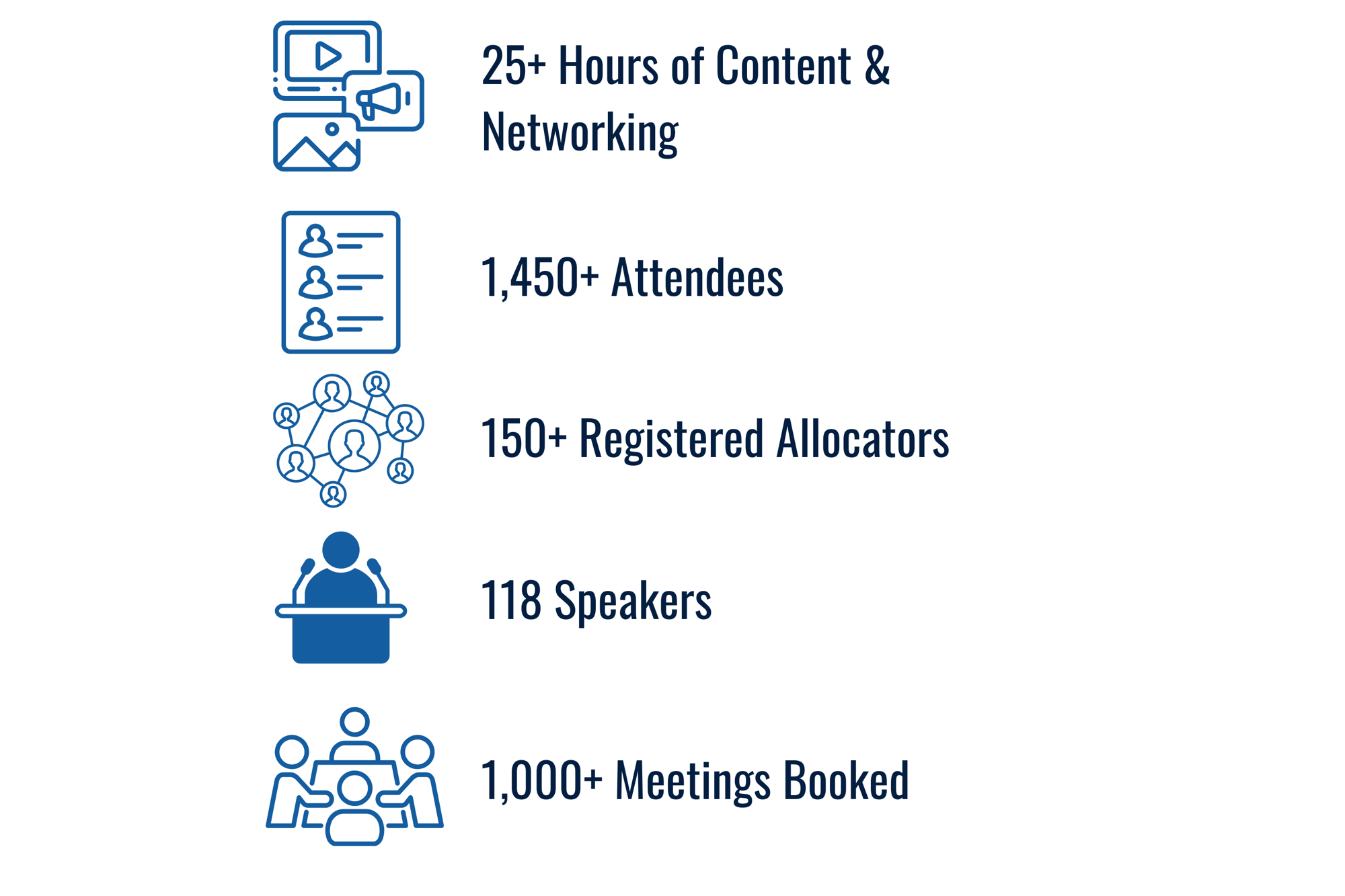

KEY STATS

NETWORKING AT-A-GLANCE

PRESS COVERAGE

Four takeaways from DealCatalyst’s private credit conference 2025

Private credit industry grapples with tariff uncertainties and AI disruption threats at Nashville conference, reports 9fin's Peter Benson and Shubham Saharan. Key themes include workout activity preparation, out-of-court restructuring preferences, software sector vulnerability to AI displacement, and expanded retail access through regulatory wins. Read More.

Size Doesn’t Matter: Middle-Market Lenders Stress Their Value

Middle-market lenders challenge industry giants at Nashville conference, reports Bloomberg's Olivia Fishlow. Smaller firms tout better returns while majors emphasize sophistication as private credit market faces consolidation and tariff uncertainties. Read More.

US: Private credit touts resilience amid economic uncertainty

Private credit demonstrates resilience amid economic uncertainties at Nashville conference, reports LSEG's April Joyner. Despite tariff concerns and slower LBO activity, industry leaders from Blackstone, Oak Hill, and HPS highlight opportunities to gain market share and tout the asset class's appeal for wealth managers seeking stability through market volatility. Read More.

Private Credit’s competitive edge: Opportunities and strategies from DealCatalyst U.S. Private Credit Conference

Private credit showcases durability as market dynamics shift at Nashville gathering, reports Octus's Sarah Chen. While tariff uncertainties linger and BSL markets face headwinds, industry veterans emphasize the asset class's streamlined execution advantages and growing investor appetite for flexible lending solutions amid changing debt capital market conditions. Read More.

Our Partnership with Culinary Care

Supporting families fighting cancer with nourishment and hope

2025 Impact at a Glance

$26.5K

26 families supported

1,200+

Families served

$1M+

First-time milestone

3

New sponsors

Key Achievements

• A new monthly donor from our Nashville event volunteered at Culinary Care's New York Cook-Off and is now engaging their entire office in supporting the mission

• One corporate sponsor has already committed to participating in Culinary Care's Corporate Cook-Off in 2026

• Culinary Care exceeded $1M in annual fundraising for the first time in their history, marking a significant milestone for the organization

"The momentum DealCatalyst helped create couldn't have come at a more important moment, as the need for nourishment and care continues to grow. Your support made a real difference — from new monthly donors to corporate sponsors stepping up to ensure families have what they need during their most challenging times."

— Courtney Johnson, CEO & Founder, Culinary Care

A SAMPLE OF THE ALLOCATORS AND FUND MANAGERS WHO ATTENDED

FUND MANAGERS

Chief Executive Officer

APOLLO GLOBAL MANAGEMENT

Partner

ARES MANAGEMENT

Partner

AUDAX PRIVATE DEBT

Managing Director

BARINGS

President

BENEFIT STREET PARTNERS

President

BLACKROCK

Head of US Direct Lending

BLACKSTONE

Senior Managing Director

BLUE OWL CAPITAL

Head of Investment Grade Private Credit

CARLYLE

Chief Investment Officer and Head of Underwriting for Direct Lending

CERBERUS CAPITAL MANAGEMENT

Managing Director

Co-Chief Executive Officer and Co-President

GOLUB CAPITAL

Vice Chair

HAYFIN

Portfolio Manager and Co-Head of Direct Lending for Private Credit

HPS INVESTMENT PARTNERS

Managing Director

KKR

Principal

MANULIFE INVESTMENT MANAGEMENT

Senior Managing Director

MARATHON ASSET MANAGEMENT

Chief Executive Officer & Chairman

OAKTREE CAPITAL MANAGEMENT

Managing Director

PARTNERS GROUP

Partner, Head Private Debt Americas

PGIM PRIVATE CAPITAL

Managing Director

SILVER POINT CAPITAL

Head of Direct Lending

ALLOCATORS

Founder

AON

AVP, Structured Solutions

AXIS CAPITAL

VP Investments

BAYSHORE CAPITAL

Partner

BRITISH COLUMBIA INVESTMENT CORPORATION

Director, Private Credit

BROOKFIELD OAKTREE WEALTH SOLUTIONS

Senior Vice President

COLORADO PERA

Senior Portfolio Manager, Alternatives

CORNELL UNIVERSITY

Real Estate Investments

GRAMERCY PARK WEALTH ADVISORS, LLC

FA, Head of Alternative Investments

INDIANA PUBLIC RETIREMENT SYSTEM

Director of Fixed Income and Private Credit

MASSACHUSETTS MUTUAL LIFE INSURANCE COMPANY

Head of Fundamental Credit Risk

Director

METRO NASHVILLE AND DAVIDSON COUNTY

Risk and Compliance Manager

MUTUAL OF OMAHA

Head of Alternatives

NEW YORK STATE TEACHERS' RETIREMENT SYSTEM

Assistant Director of Private Equity

OMERS

Head of Alternative Investments

SANCTUARY WEALTH

Managing Director, Head of Manager Research and Alternative Investments

SOMERVILLE RETIREMENT BOARD

Executive Director

STATE OF TENNESSEE TREASURY

Portfolio Manager

STEPSTONE GROUP

Head of Private Debt Advisory

UNIVERSITY PENSION PLAN ONTARIO

Associate Director, Private Debt

VIRGINIA RETIREMENT SYSTEM

Investment Officer

Private Credit Club members enjoyed special perks at the conference including:

- Access to our members' only "Private Credit Club Saloon" Networking Lounge

- A GP & LP Welcome Brunch co-hosted by McDermott Will & Emery where we have a 1:1 ratio of GPs and LPs

- A closed-door Allocators' Breakfast co-hosted by Pitchbook for a peer-to-peer market discussion

- Fund manager members shared their IR decks with all allocators ahead of the event, resulting in 4.5 hours of view time by 40 unique allocators

- Personalized LP and GP introductions

Private Credit Club membership is open to GPs, LPs, and Borrowers. Join today to be invited to special events and enjoy these member benefits at our next event. For more information, please visit privatecreditclub.com.

WHAT ATTENDEES SAID ABOUT THE CONFERENCE

"The 2025 US Private Credit Industry Conference on Direct Lending in Nashville was an excellent event. The content was relevant, timely, and insightful, and it was great to reconnect with industry peers and leaders."

Partner, Bayshore Capital

"Congratulations on an excellent conference! I think it's the best I've ever attended on the subject. Great networking opportunities, lots of LPs, and great speakers."

Investor Relations, Onate

"I found the entire production smooth and efficient and the quality of the attendees was amazing."

Head of Private Credit, Cresset Partners

"Your conference yet again turned out to be very informative and an excellent forum for networking."

Senior Director, Asset Management, Sumitomo Mitsui Trust Bank

“The U.S. Private Credit Industry Conference on Direct Lending was very well done, timely and quite informative.”

Insurance Company Allocator

“I just wanted to thank you again for the invitation to the event. We really enjoyed it, and we found it to be very well run and productive.”

Chief Executive Officer & Managing Partner, Remora Capital Partners

"Very few events during the year are as effective at getting everyone in our private credit orbit to the same location at the same time."

President, Leading U.S.- Based BDC

"The event was well-attended by key industry people who shared great insights. As a sponsor/exhibitor, we came away with many quality connections and opportunities."

CEO, LendOS

“Thank you so much for the truly remarkable organization of the event. You and your team did an incredible job, and we all felt very welcomed by your amazing hospitality.”

Director & Portfolio Manager, True North Capital

“What a hugely successful event it was this year. A massive congrats to the DealCatalyst team!!”

Managing Director, KBRA Analytics

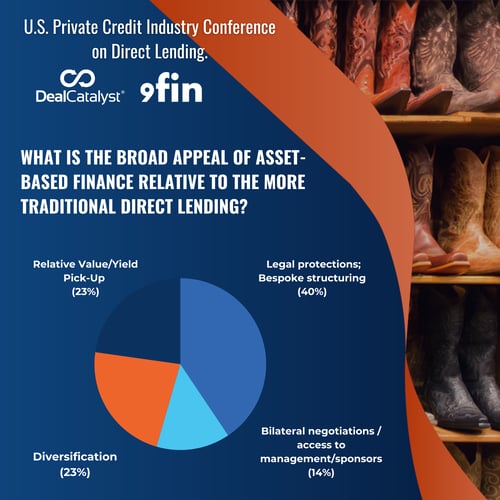

AUDIENCE PULSE SURVEYS

THANK YOU TO OUR 2025 SPONSORS AND PARTNERS